No Pressure

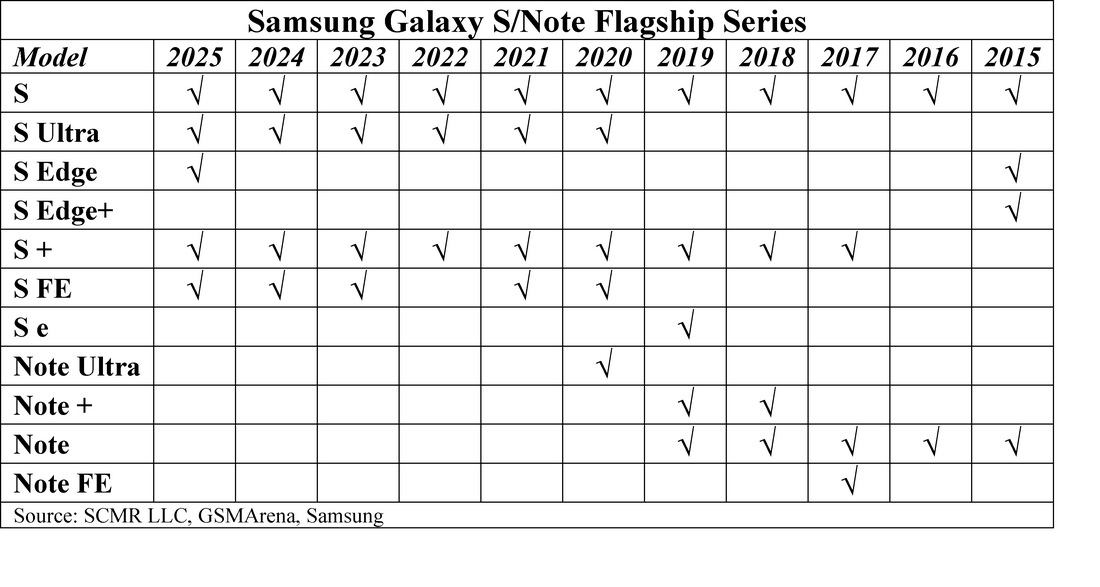

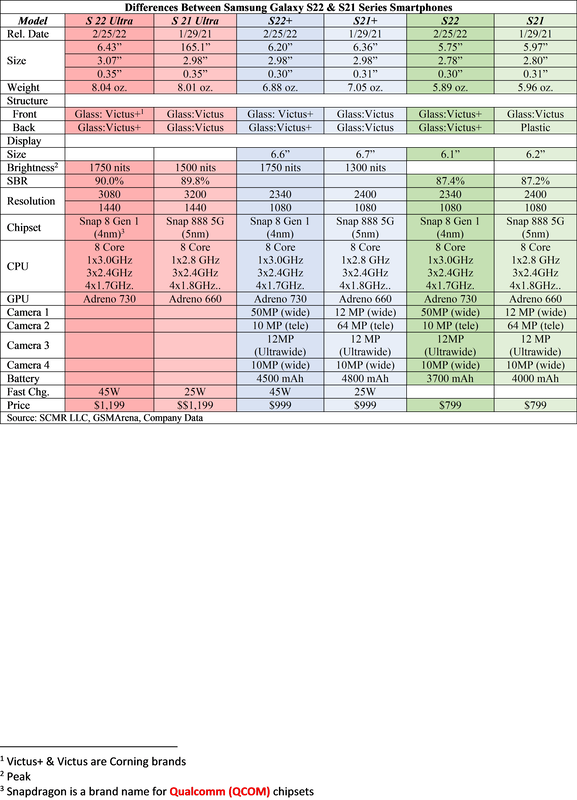

As consumers’ wants evolve, brands must adapt and offer a more or less diverse line of phones to broaden their customer base. In some cases this means segmenting price points or feature sets, but shipments and share are the goalposts in the smartphone business and new models must perform or they drag down the brand and eat into profits. The planning for new models is a complex issue as it rests on both the expertise of the brand’s marketing department and the company’s technical ability to satisfy evolving customer needs. While brands can test new devices internally, using staff and focus groups, given the competitive nature of these products and the number of folks trying to get a peek before release, much depends on the expertise of the internal organization and even the most experienced product developers sometimes miscalculate, as it is very easy to convince oneself that such decisions are correct when your job depends on it. The table below shows how Samsung’s Galaxy line models have evolved over the years.

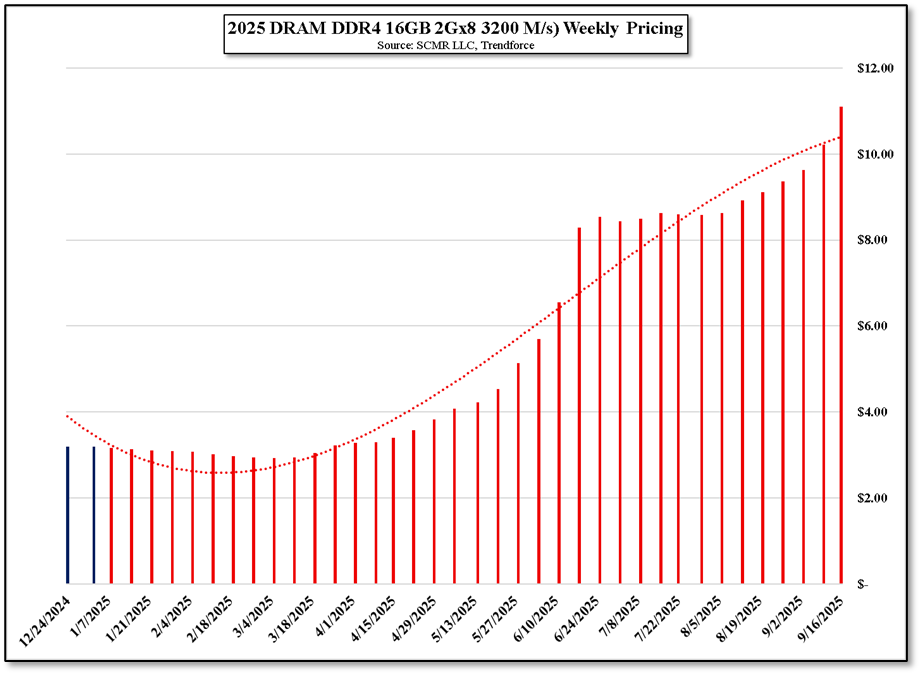

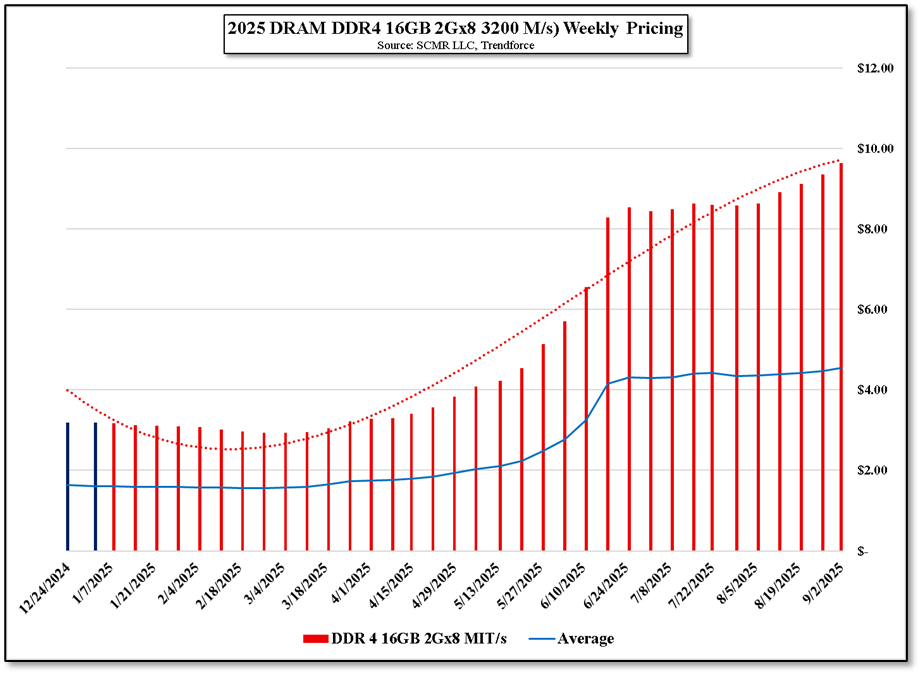

According to industry sources here are the expected production volumes for the period between September and December:

- Galaxy 25 Edge 300,000

- Galaxy S25+ 500,000

- Galaxy S25 2,900,000

- Galaxy S25 Ultra 3,400,000

Actual mass production for the displays begins later this month, although both the Galaxy S26+ and the Galaxy S26 Edge will use the same display, making early orders less dependent on a final decision. That said, Samsung usually announces the upcoming Galaxy S series line in late January to early February, so a decision does need to be made soon. The default would be to produce all four, but with the company trying to squeeze as much margin as possible out of the mobile division, three would likely be more profitable if they could boost sales for whichever model is chosen. As both the S+ and the Edge sit between the Ultra and the standard Galaxy S, price will be more difficult to maneuver, which means features will likely be the selling point without overshadowing the Ultra. No pressure…

RSS Feed

RSS Feed